Assembly Bill 386 amends existing law and would give investigators from the state’s Department of Justice more time to access financial records.

Until this point, an investigation can only extend to 30 days before the incident and 30 days after it. The new bill proposes to amend this to 90 days before and 90 days after the alleged illegal activity. The measure’s author is Elk Grove Democratic Assembly member Stephanie Nguyen, who also represents Sacramento.

"Right now, if you are a victim of a financial crime, the first thing they'll do is an investigation, but the investigation only goes 30 days prior to the incident and 30 days after,” she said at a hearing of the Assembly Committee on Privacy and Consumer Protection earlier this month. “That is not enough time to take a look at your spending habits, to see whether or not this really is financial abuse."

Amanda Kirchner, who also spoke at the hearing, is with the bill's sponsor, the County Welfare Directors Association of California. She says this extension of time has the potential to make a difference for investigators.

"They can look at a greater number of financial documents as well as a long term pattern over a greater amount of time so they can look at some of these scams that are coming in for fraudulent transactions," she said.

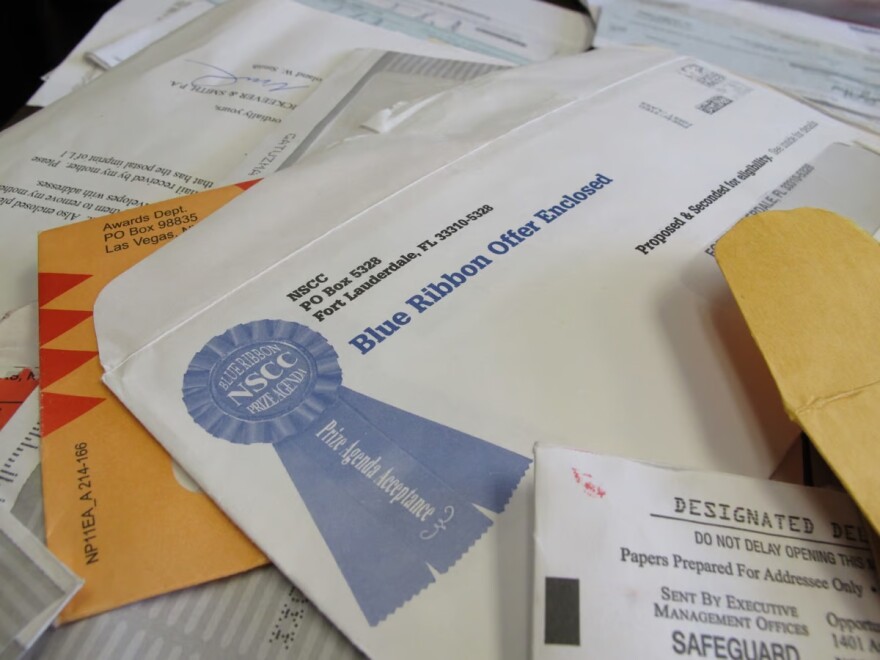

Nguyen says those trying to scam California’s seniors have become bolder in their efforts to take advantage of these older people.

“We’ve all received calls or text message scams, unfortunately, many of our seniors have difficulty identifying if it is a scam or not, making them a prime target for financial abuse,” she said.

AB 386 has its detractors, as well. Robert Wilson, Senior Vice President for State Government Affairs with the California and Nevada Credit Union Leagues, described his organization’s reservations.

"Our credit unions are still a little concerned with the 90 days on both ends,” he said. “It's going to increase the amount of records that are going to be pulled and those time frames have always been in place to ensure financial protection for individuals."

Wilson said his organization is working with Nguyen's staff regarding its concerns with the bill.

Nguyen’s bill passed the Assembly Privacy and Consumer Protection Committee on an 11-0 vote and heads next to the Appropriations Committee.

The Public Policy Institute of California reports that by 2030, it is estimated one in five Californians will be 65 years of age or older. That’s four million more people than today’s population of those 65 or older.

Copyright 2023 CapRadio