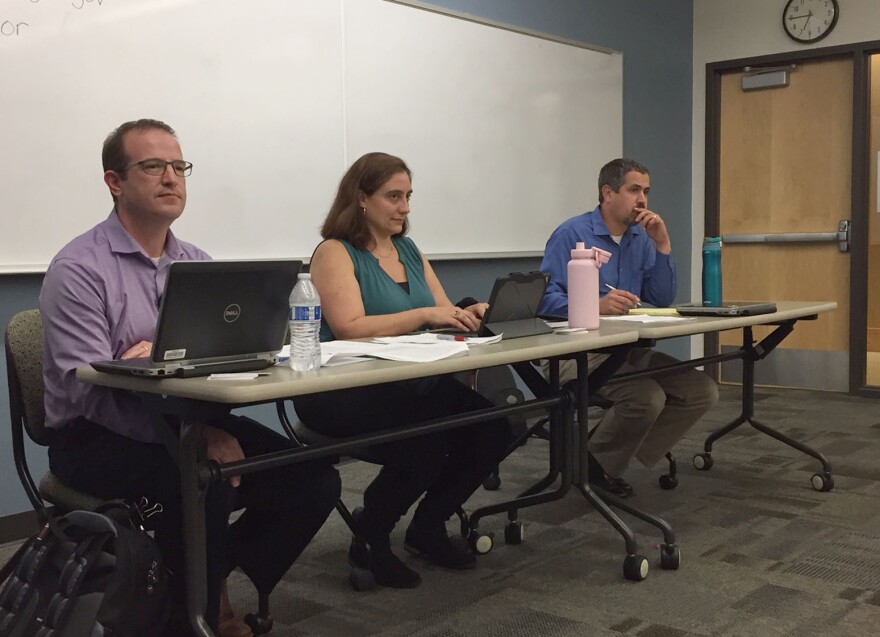

The first public meeting in the Rogue Valley to discuss Oregon’s new Corporate Activity Tax was held Tuesday night in Medford.

Officials from the Oregon Department of Revenue answered questions and listened to concerns from business owners about the new tax.

Michael Campbell is a co-owner of Siskiyou Cellular. He was concerned about how the new tax scheme could affect his stores. Campbell's business includes selling cellular phones for phone carriers, but, he says, he doesn’t make any money off the transactions.

“I came to the meeting today to make sure that the people who are developing the rules for this understand some of those nuances, so that businesses aren’t being taxed unfairly on things that they’re not making any profit on,” Campbell said.

The Corporate Activity Tax was signed into law in May. It applies to businesses that have over $1 million in commercial activity within the state. Such businesses will be charged an annual $250, plus a 0.57 percent tax on commercial activity above the first $1 million.

The program will bring an estimated $1 billion per year to K-12 public education in Oregon.

The town hall meetings are as much for managers at the Oregon Department of Revenue to understand unique scenarios for the tax program on businesses as it is to answer questions, officials said on Tuesday night.

“The most important thing we’re getting out of these meetings is the input from the communities, from the business owners, from the tax preparers,” said Leah Putnam, the Corporate Activity Tax program manager.

Along with stories like Campbell’s, Putnam is assessing how the Oregon-based tax should apply to inter-state commerce with trucking companies or airlines. Or how frequently products should be taxed throughout the supply chain, such as from manufacturer to retailer, and from retailer to consumer.

“Some of this is going to be really specific to the facts and circumstances of how big business or smaller business, how they’re set up,” Putnam said.

The Oregon Department of Revenue will be addressing diverse business scenarios at town hall events throughout the state in the coming week.